Radar: Retailers clamor to China for success

While Americans are looking for spare change, the Chinese are emptying their pockets. The world’s most populated country now has a growing middle class. It used to be that only the rich jetsetters of China could afford luxury American brands, but now the tides are slowly turning. As their currency maintains it’s weight and per capita income rises, so does the buying power of the one of the most influential markets in the world.

Just last weekend, the consulting firm A.T. Kearney revealed their ninth annual study on markets with the greatest potential for retail development (GRDI). While India and Russia dominated results in 2009, this year China was considered number one in terms of propensity for market expansion.

Hana Ben-Shabat, a partner at Kearney that worked on the study, told WWD, since the yuan has appreciated against the dollar, “the purchasing power of the Chinese consumer is really going to increase. If you’re sourcing there, prices are going to go up, but selling to the Chinese is going to become easier.”

While some companies have already established success stories in China, such as Nike, others have realized that it takes some research to make it in their market. American Apparel, a brand admired for a simple, hip look and lack of labels, was unrecognizable to the Chinese, a group of consumers that enjoy brand-happy products such as Coach and Louis Vuitton.

CEO of American Apparel, Dov Charney told WWD, “They [Chinese consumers] are looking for the Rolls Royce right now… They are not looking to buy the Volvo.”

While some companies, like Levis and Gap, do well internationally… it’s not the case for most middle-class American brands. Gap’s sister company, J.Crew has no plans of expansion. However, their recent partnership with Net-a-porter, made their products available in 170 countries, a huge leap for the U.S. based brand.

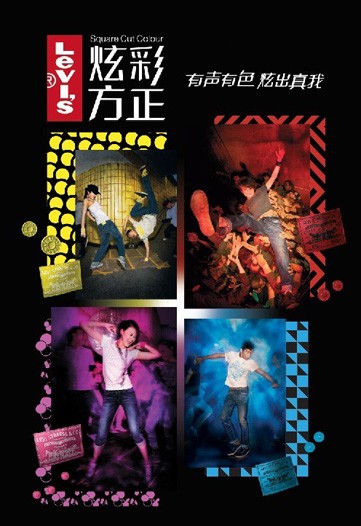

Levi Strauss, which had very successful campaigns in China, has decided to launch a new brand aimed specifically at their Chinese consumer.

Christopher Tang, a professor at UCLA Anderson School of Management, brought up an important factor in China’s economy – the wage gap. Middle class shopping to the Chinese is not comparable to their American counterparts. He told WWD, “For those who have disposable income, they go for the high-end brands. For those who are more price-sensitive, they go for the local brands.” He went on to say, “The middle range price for the U.S. market is still expensive in China.”

Paul Marciano, CEO of Guess, summed it up well, “It’s a country where it requires us to be very cautious, to go not as fast as you can but as carefully as you can.”

With 92 percent of retailers hoping to expand beyond their borders, this study couldn’t come at a more relevant time. As American brands slowly lose their nationality and China’s population grows, it’s not a jump to say China could start wearing us…more than we do.

Levi's